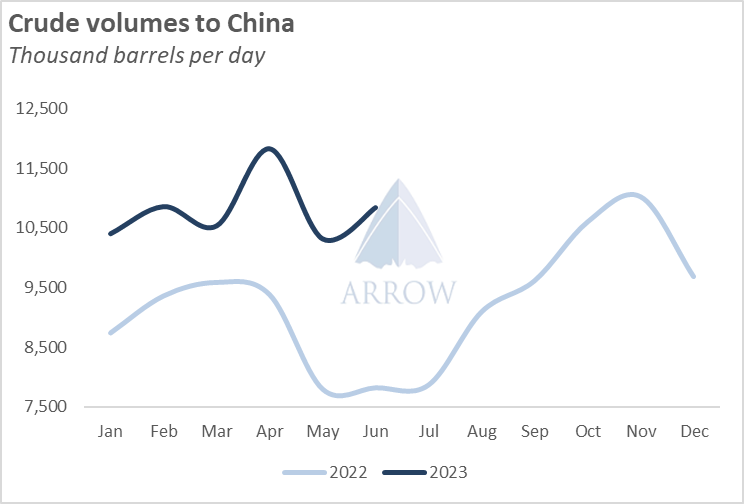

China’s appetite for crude oil has been the major driver for global demand this year, outstripping volumes in 2022, with an average monthly year-on-year increase of 24%. Domestic crude demand has risen, but we expect to see an increase in clean product exports to the Asia Pacific region and potentially further afield as well.

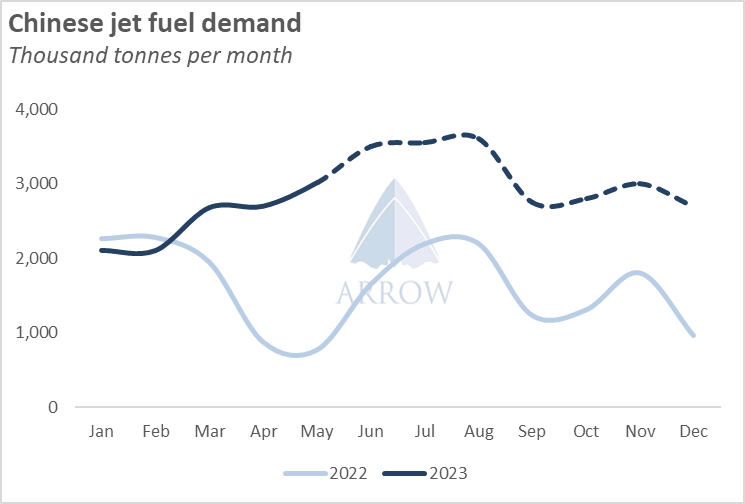

China’s growing demand for Jet fuel has been almost insatiable with refineries optimising to produce middle distillates. However, this has left it with a surplus of other middle distillate products such as gasoil/diesel. China is structurally net long in jet (+1.7 MT/month on avg 2022), gasoline (+1.1 MT/month avg 2022) and gasoil/diesel (+900KT/month avg 2022). These product surpluses are going to increase as capacity grows and should lead to higher exports as crude supply tightens and refining margins improve within the region.

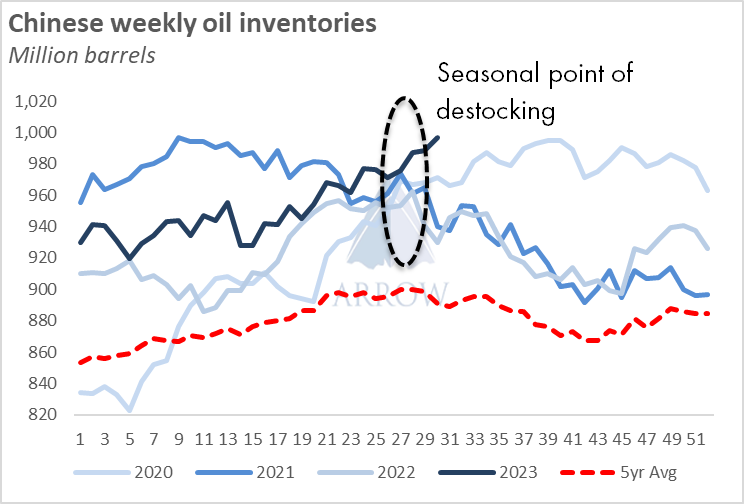

As of today, Chinese refineries are almost entirely out of turnarounds, with a few nationally owned still undertaking maintenance. During the downtime, China stored oil that was not being put through the refineries, while also continuing to take advantage, and stockpile, cheap Russian oil which has a high yield for middle distillates.

This has led to higher inventories, exceeding levels for the past five years. Normally, post maintenance season, we see a gradual decline in inventories, however this has not happened, and the country is even outstripping 2020’s peak pandemic inventory levels. Bearing in mind that the summer season is upon us there is bound to be an increase in domestic utilisation. Crude bought at reduced prices will also give an extra boost to refiners’ margins as demand picks up and exports rise.

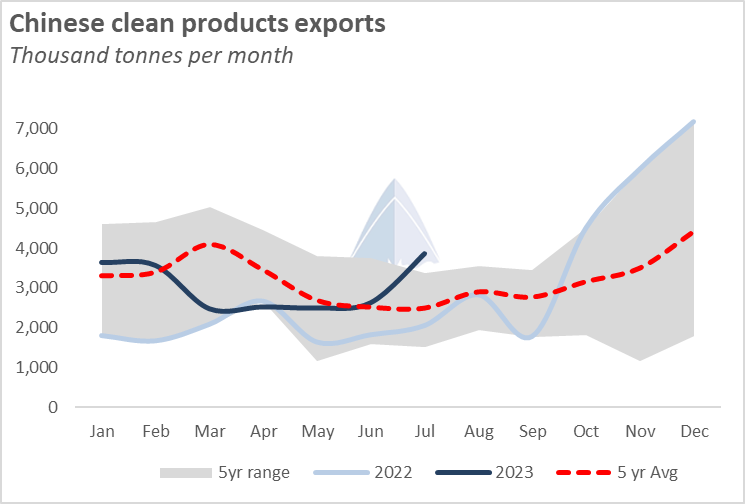

Despite rising domestic consumption in July, we have seen China exporting 60% more clean products on average this year, pushing out of its 5-year range. Higher exports are in part driven by China’s growing refining industry. The additional refining capacity of over 1mb/d since 2020 has meant an increased production of clean products. In addition, exports have historically exceeded the export quotas, which means that there is scope for further increases in exports. Considering the inventory levels, we are likely to see an increase in shipments going forward, specifically in gasoil and diesel which have increased by 98% (+260KT) and 246% (+714KT) respectively for the first 6 months of 2023 compared to the previous year, driven by a surplus from refinery optimisation and rising margins.

2023-08-09

2023-11-08